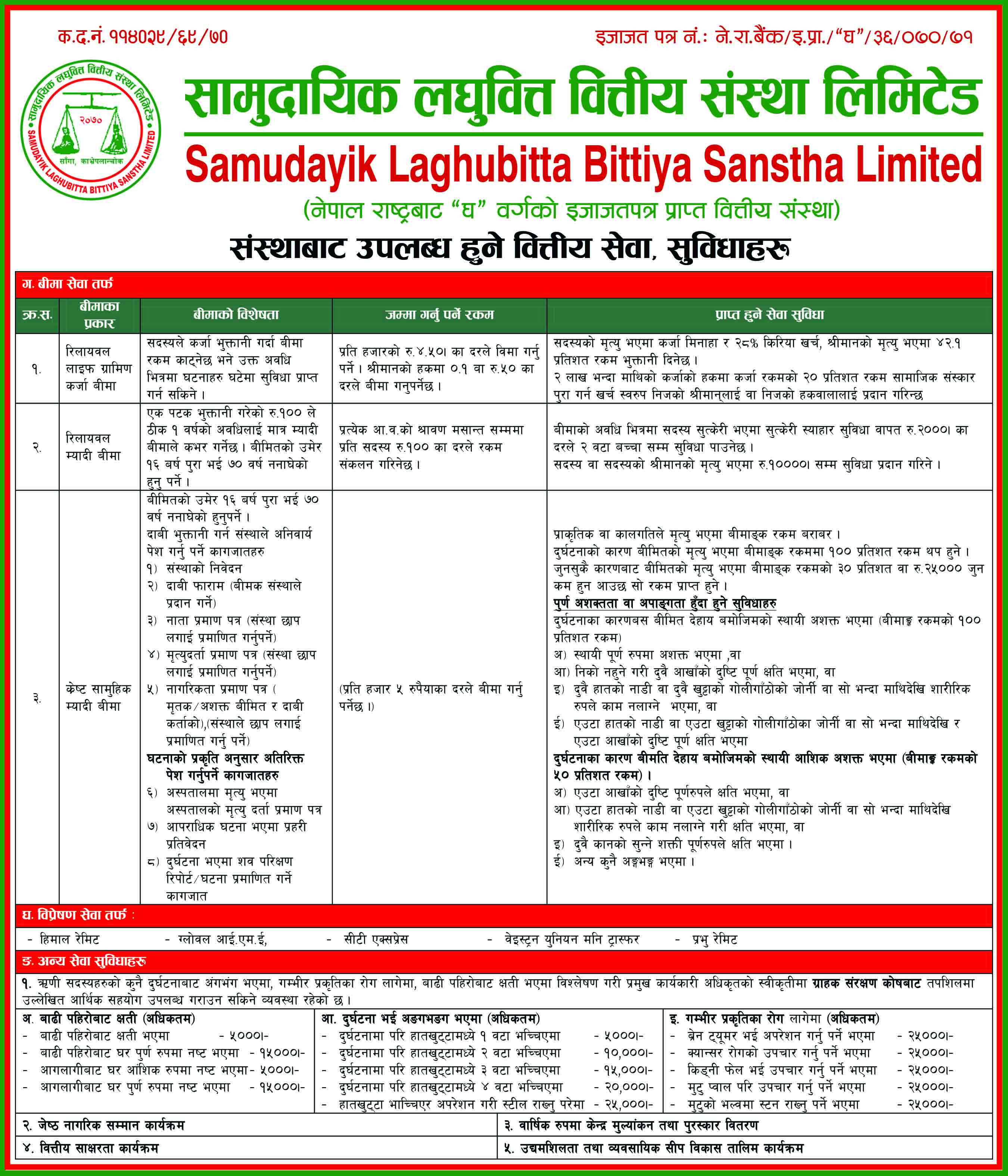

Our Product And Services

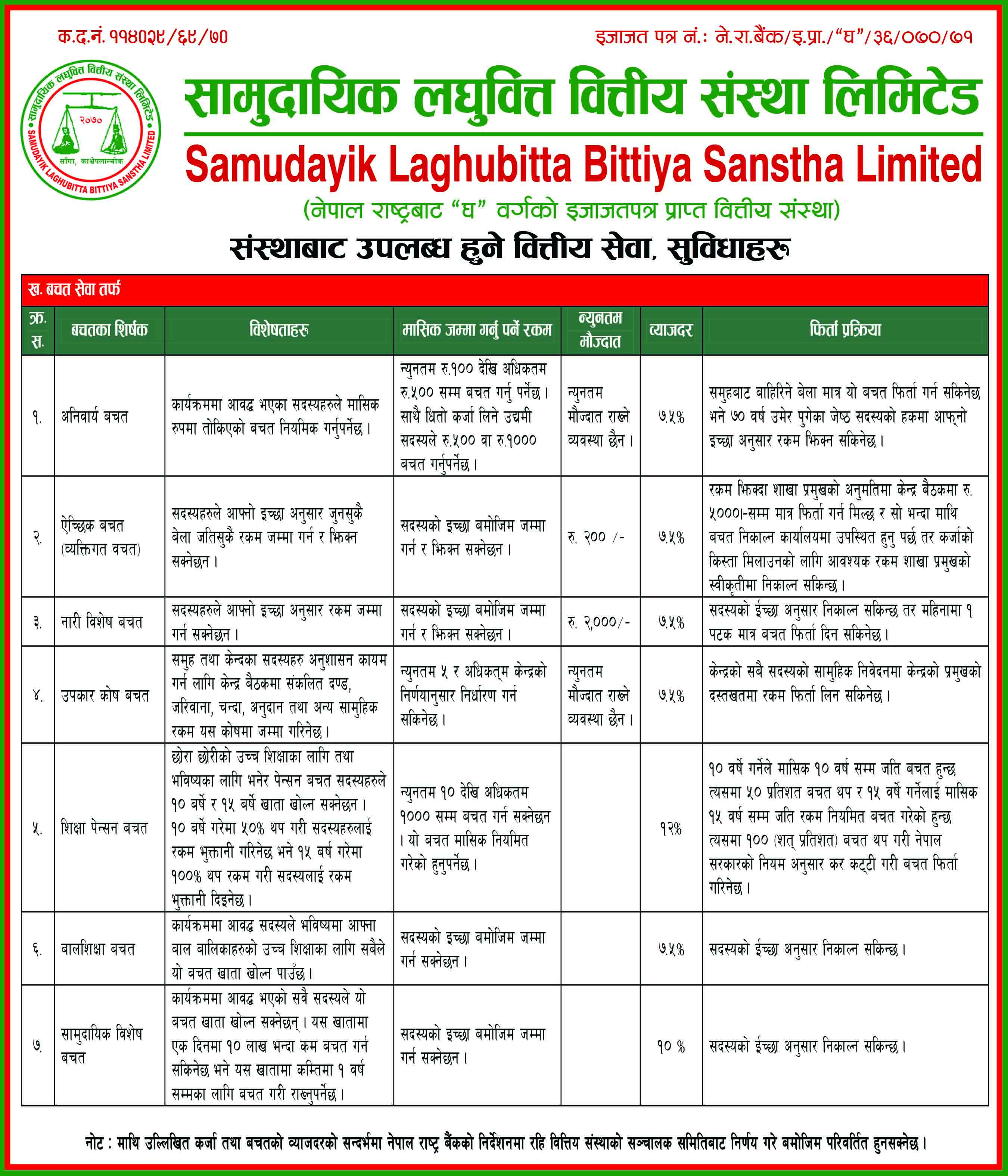

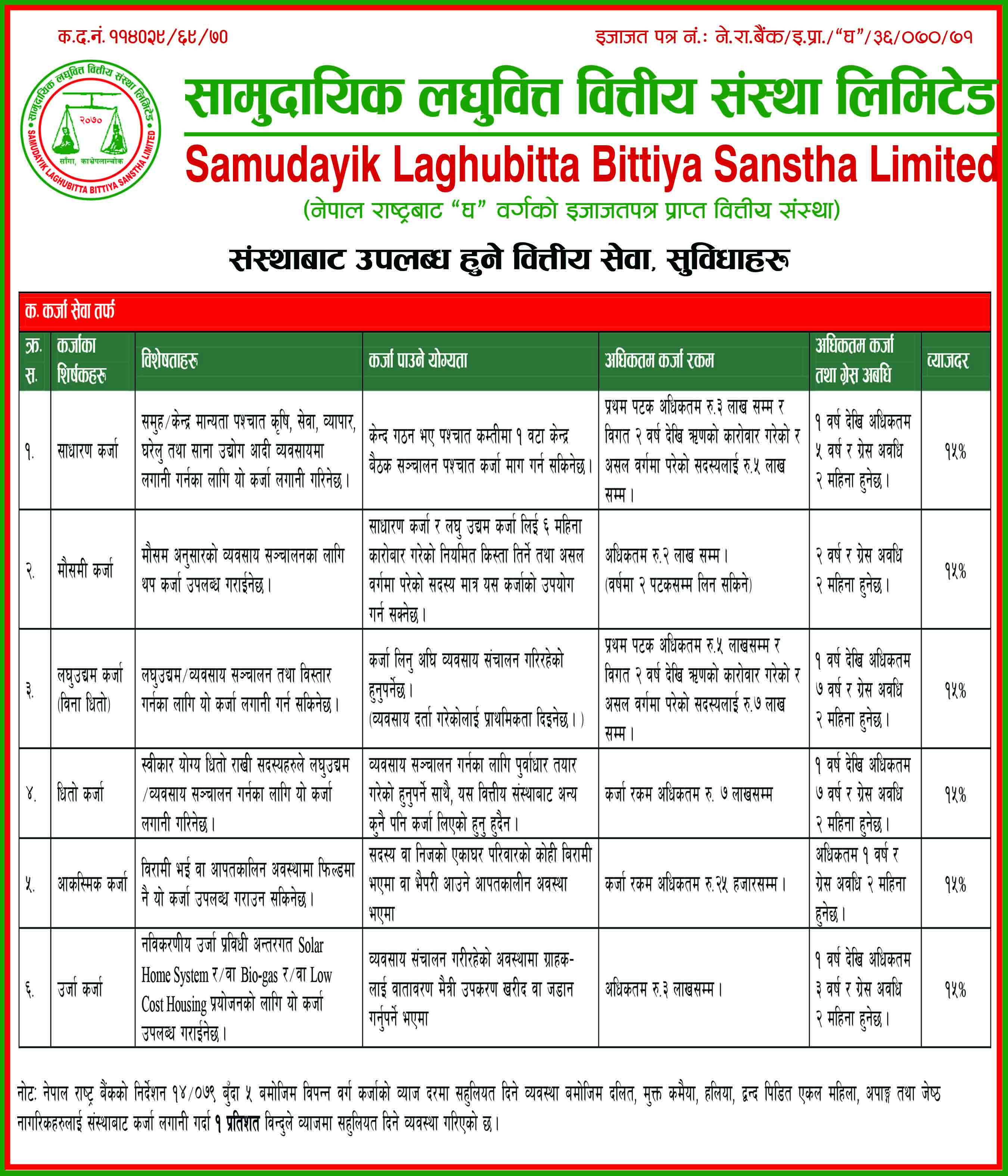

Our Saving and Loan Interest Rates: Download Interest Rates

International Money Express(IME): We have started IME remittance system in branches so that you can send and receive your hard earned money from our branches.

Himal Remittance: We are also serving our customers through Himal Remit.

City Express: We also provide service to our member through city express money transfer.

Western Union Money Transfer: We serve our customers by western union money transfer as receiver.

Prabhu Remit: We are also providing our member with Prabhu Remit facilities for money transfer and receiving.